Blog

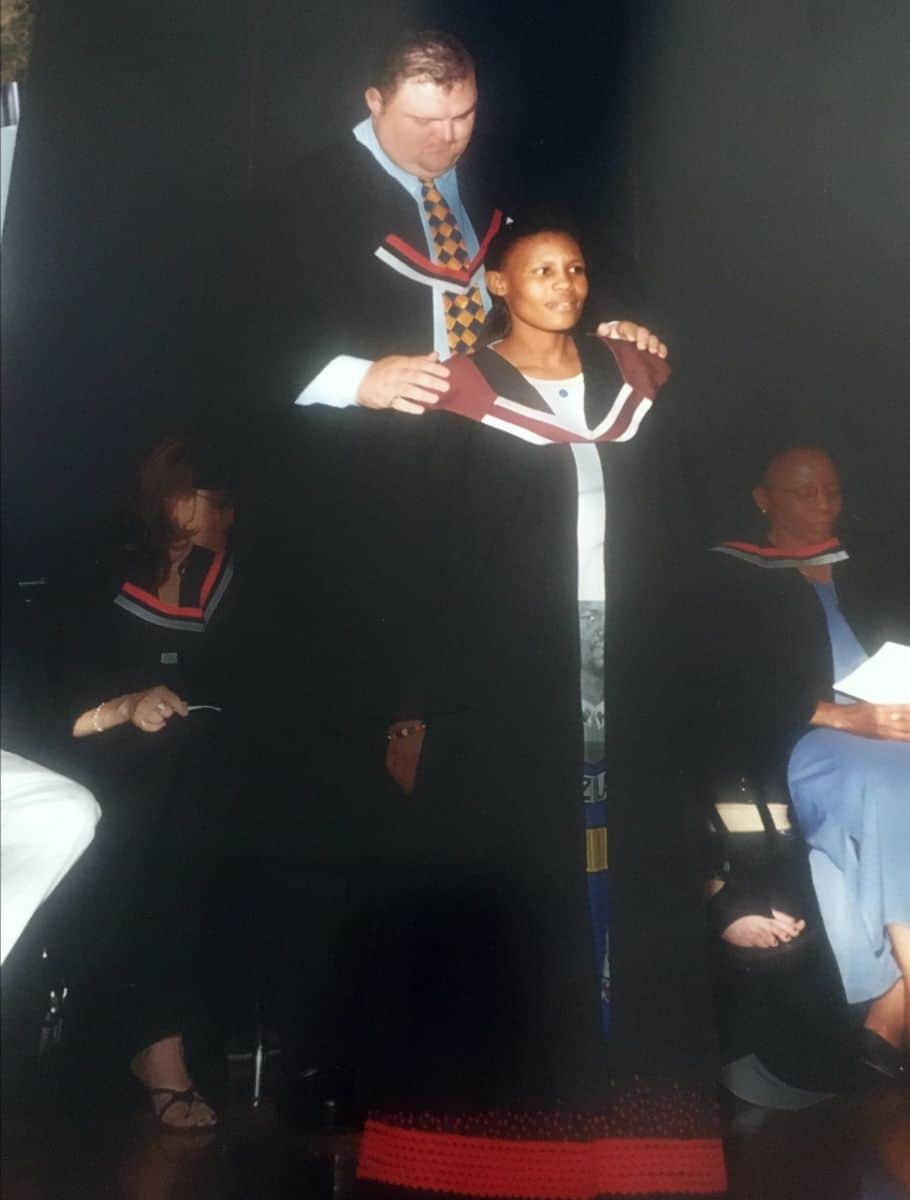

Planning for an Education- Masesi Masilela

0 Comment Masesi Masilela didn’t sleep the entire 20-hour long ride. She had bid farewell to her parents, and with a few belongings and some cash, she boarded a bus and set off to college – over 1,500 km away.

Masesi Masilela didn’t sleep the entire 20-hour long ride. She had bid farewell to her parents, and with a few belongings and some cash, she boarded a bus and set off to college – over 1,500 km away.

“I showed up with enough money to pay for registration, tuition, books, and accommodations,” says Masesi. “I remember thinking then that none of this would be possible without that money.”

Masesi grew up in South Africa. The oldest in her family, she recalls her parents always having a focus on education. Her parents had only received a grade 8 education, and wanted more for their children. Even though it was a challenge to be so far away from home, this experience was affirming for Masesi.

“It was difficult to be far away from my family,” says Masesi. “But this is where I really learned to stand on my own two feet.”

When Masesi finished school without a student loan, she was able to jump into a career she was eager to pursue. While her friends were struggling with paying off their debt, she saved and was able to buy herself a car.

“This is when I realised it was more than just money that made education possible,” Masesi says. “My parents carefully planned, sacrificed, and saved. And I was successful because of that opportunity.”

Masesi applies this valuable lesson to her own parenting. When she and her husband Lawrence moved to Canada from South Africa in 2008, she knew she would plan and save just as carefully for her own two children.

“As always, money remains a big challenge for kids going to college,” says Masesi. “But I think the root of this is often planning. If we planned for the financial piece of our children’s education, it wouldn’t seem like such a huge task.”

“I believe it’s so important to plan for your children, and with your children,” she adds.

Saving for her children’s education was always a big part of this planning process. When Masesi first learned about RESPs, she was a little blown away.

“I save some money, and the government gives me some, too?” she laughs. “I remember thinking ‘whoa, let’s do this!’”

But Masesi recognized that saving for her children’s education also meant further educating herself – by reaching out to others for more information that would help her and her husband plan.

“I was not well-versed in this kind of thing, so it was important for us to sit down with someone who knows,” Masesi says. “When we started, we wanted to know if time would be on our side. It’s not easy to talk about finances, but it is important.”

Masesi believes that finding this kind of information is crucial for parents who are just starting to plan. Because of this, she believes organisations like READ Saskatoon have an invaluable role to play.

“READ Saskatoon is a great place to seek advice and gain some perspective,” says Masesi. “It’s a place to start talking about saving for your children that will get you headed in the right direction. It will give you courage to start making a plan and get make some connections.”

“It’s hard to start, but it’s worth it,” she adds. “This kind of financial planning is really 20% knowledge and 80% behaviour. Once you know better, you can do better.”

Financial planning for your children’s future not only sets them up for less burden later on, but it also encourages them to dream and plan for the future knowing they have the support and encouragement from their parents.

“I never ask my kids what they want to be when they grow up,” says Masesi. “I’ve always asked them what need they are going to meet?”

“When you commit to investing in your children’s financial future, you are helping your children commit to their own dreams. Those dreams may change, but because of your investment, they will have the support they need to go out and make the world a better place for all of us.”