Blog

RESPs- The Earlier You Start The Better Off You’ll Be – Steve Peace

0 Comment

“It is possible! If a single mother of 8 can do it, so can you!”

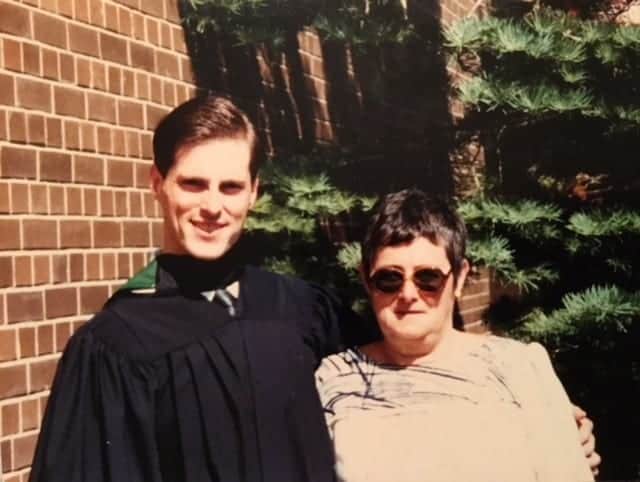

Steve Peace shares his encouragement with families he meets through his work at Conexus Credit Union. As a financial advisor, he knows how important it is for families to save for their children’s education. But it was from his mother where he first learned this important lesson.

“Mom had 8 kids under the age of 13 when dad left,” explains Steve. “At that point, she decided she needed to go back to school to be able to support herself and her children.”

His mother Joan would go on to complete a university degree which would enable her to get a job as a social worker with the local school board in Kitchener, Ontario. It was this decision that would help to instill the precious value of a good education on Steve and his siblings.

“I still wonder how she did it,” he says. “But she made it clear that education was a priority, and she taught us by example.”

Beyond putting herself through school, Joan also saved for all her children, ensuring that half of their education would be paid for. The other half, Steve saved by working on the weekends.

“I worked night shifts at McDonalds every Friday and Saturday,” says Steve. “This allowed me to focus on my schoolwork during the week, and work towards paying for my education on the weekends.”

It was a challenge, but both his studies and his saving helped put life into perspective, and opened many doors along the way.

“Education is about so much more than just what you focus on in school,” he says. “It teaches you about commitment, responsibility, and how to think critically.”

After receiving a three-year degree, Steve was able to get a  job as a bank manager trainee. This opportunity was made possible because of his education, but also gave him the opportunity to continue learning.

job as a bank manager trainee. This opportunity was made possible because of his education, but also gave him the opportunity to continue learning.

“I’ve been in the financial services industry for close to thirty years,” says Steve. “I got there because I had a university degree. But it’s really about the skills it provided me that enabled me to keep learning for my career.”

Without a doubt, Steve believes the biggest challenge young people face is the cost of education. And through his work he gets to encourage families to think and plan carefully for their children’s futures.

“Debt is not just a financial burden, it causes stress and all kinds of well-being problems, too,” he says. “There are so many other firsts when you leave home, and worrying about money doesn’t need to be one of them.”

Because of this, Steve believes in the power of RESPs, and hopes more parents will take the time to talk to someone about the benefits.

“Like retirement, sometimes we don’t see the immediate need to save,” he says. “We live in the day to day struggles, and try to balance our budgets, so something far off into the future can feel like a low priority.”

But the benefits are huge. Saving even a little every month can make a massive difference, especially if you begin to save early.

“Compound interest when you’re saving is definitely your friend,” he says. “The earlier you start, the better off you’ll be.”

It can be difficult to know where to begin, and Steve thinks organizations like READ Saskatoon can be a great stepping stone for information.

“Getting started is the hardest part,” he admits. “READ Saskatoon programs are a great place to start talking and sharing. It plants the seed, and makes it easier to get started with great information they can take home and think about.”

Steve believes that when parents make their children’s education a priority, that children will too.

“Parents can reflect and pass on their values to their children,” he says. “All parents want the best for their kids, and saving for their education will help ensure they can dream big for the future.”